Why You Need a Stellar Bank Teller Cover Letter

In the competitive world of banking, a well-crafted cover letter is your key to unlocking the door to a bank teller position. It’s your first impression, a chance to showcase your personality, skills, and enthusiasm beyond what’s listed on your resume. Without a stellar cover letter, your application might get lost in the stack. This document allows you to connect with the hiring manager on a personal level, highlighting how your unique qualifications align with the bank’s specific needs and culture. It’s not just about repeating your resume; it’s about telling a compelling story, demonstrating your genuine interest in the role and the financial institution. A strong cover letter sets you apart, demonstrating your commitment and attention to detail, qualities that are highly valued in the banking industry. Think of it as your personal sales pitch, designed to persuade the employer to invite you for an interview. A generic or poorly written cover letter can instantly disqualify you, so invest time and effort into crafting a document that shines.

Highlighting Your Skills and Qualifications

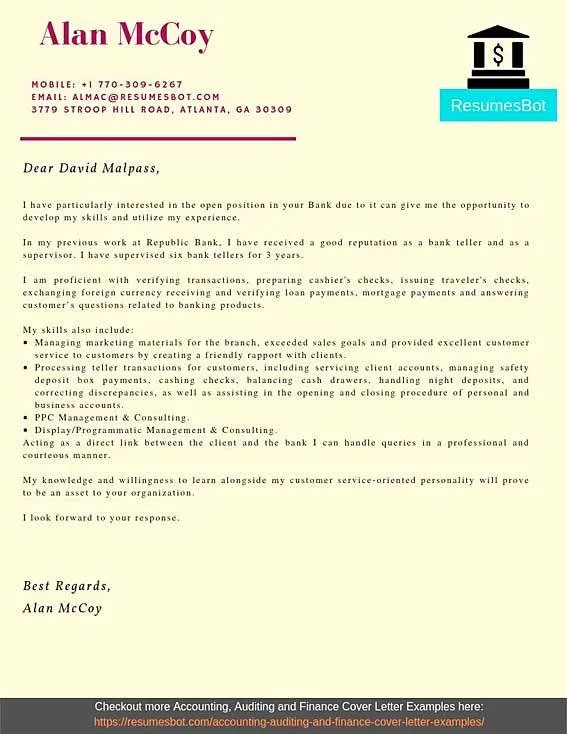

When crafting your cover letter, focus on skills and qualifications that directly align with the bank teller job description. Highlight your customer service abilities, emphasizing your experience in handling customer inquiries, resolving issues, and providing excellent service. Mention your communication skills, both written and verbal, as clear and concise communication is essential in this role. Showcase your attention to detail and accuracy, especially when handling financial transactions and sensitive information. If you have experience with cash handling, such as counting, balancing, and processing deposits and withdrawals, be sure to include that. Any experience with point-of-sale systems or banking software is also valuable. Moreover, if you possess any relevant certifications, such as those related to customer service or financial literacy, list them prominently. Make sure to provide specific examples that demonstrate how you’ve applied these skills in previous roles, quantifying your achievements whenever possible, such as the number of customers served or the accuracy rate in handling transactions. Show, don’t just tell.

Emphasizing Relevant Experience

Your work experience is a crucial component of your cover letter. Even if your experience isn’t directly in banking, look for transferable skills. For example, if you’ve worked in retail, highlight your experience with cash handling, customer interaction, and problem-solving. If you have experience in any role that requires handling money or data entry, be sure to mention it. Tailor your cover letter to the specific bank and the specific job requirements, highlighting experience that aligns with their needs. When describing your previous roles, use action verbs to showcase your accomplishments and responsibilities. Instead of simply stating your duties, provide examples of how you excelled in those roles. For instance, describe how you improved customer satisfaction, streamlined processes, or exceeded sales targets. Quantify your achievements whenever possible to demonstrate your impact, such as the number of transactions you processed per day or the reduction in errors you achieved. Also, show your eagerness to learn and develop new skills within the banking industry and the specific bank.

Formatting Your Cover Letter Effectively

Choosing the Right Font and Font Size

The aesthetics of your cover letter are just as important as the content. Choosing a professional font and font size is key to readability. Select a standard font like Times New Roman, Arial, or Calibri. These fonts are clean, easy to read, and widely accepted in professional documents. Avoid using overly stylized or decorative fonts, as they can be distracting and make your letter difficult to read. The recommended font size is between 11 and 12 points. This size is large enough to be easily readable, without taking up too much space. Use consistent formatting throughout your letter, including the same font, size, and spacing. Ensure your margins are set to one inch on all sides for a balanced and organized appearance. Proper formatting demonstrates your attention to detail and professionalism, which are highly valued in the banking industry. A well-formatted cover letter will make a positive impression on the hiring manager, making your application more likely to be read and considered.

Using a Professional Tone

Maintaining a professional tone is essential for any cover letter. Use formal language, avoiding slang, contractions, and colloquialisms. Address the hiring manager by name whenever possible; if you can’t find a name, use a respectful title like “Dear Hiring Manager.” Keep your language clear, concise, and to the point. Avoid overly long sentences or paragraphs. Proofread your letter carefully for any grammatical errors or typos, as they can reflect poorly on your attention to detail. Be positive and enthusiastic in your tone, expressing your genuine interest in the bank teller position and the bank itself. Demonstrate respect for the reader and the organization by using polite and courteous language. When describing your skills and experience, use confident but not arrogant language. Tailor your tone to match the culture of the bank. By using a professional tone, you’ll project the image of a serious and capable candidate, increasing your chances of making a positive impression on the hiring manager and being selected for an interview.

Structuring Your Cover Letter

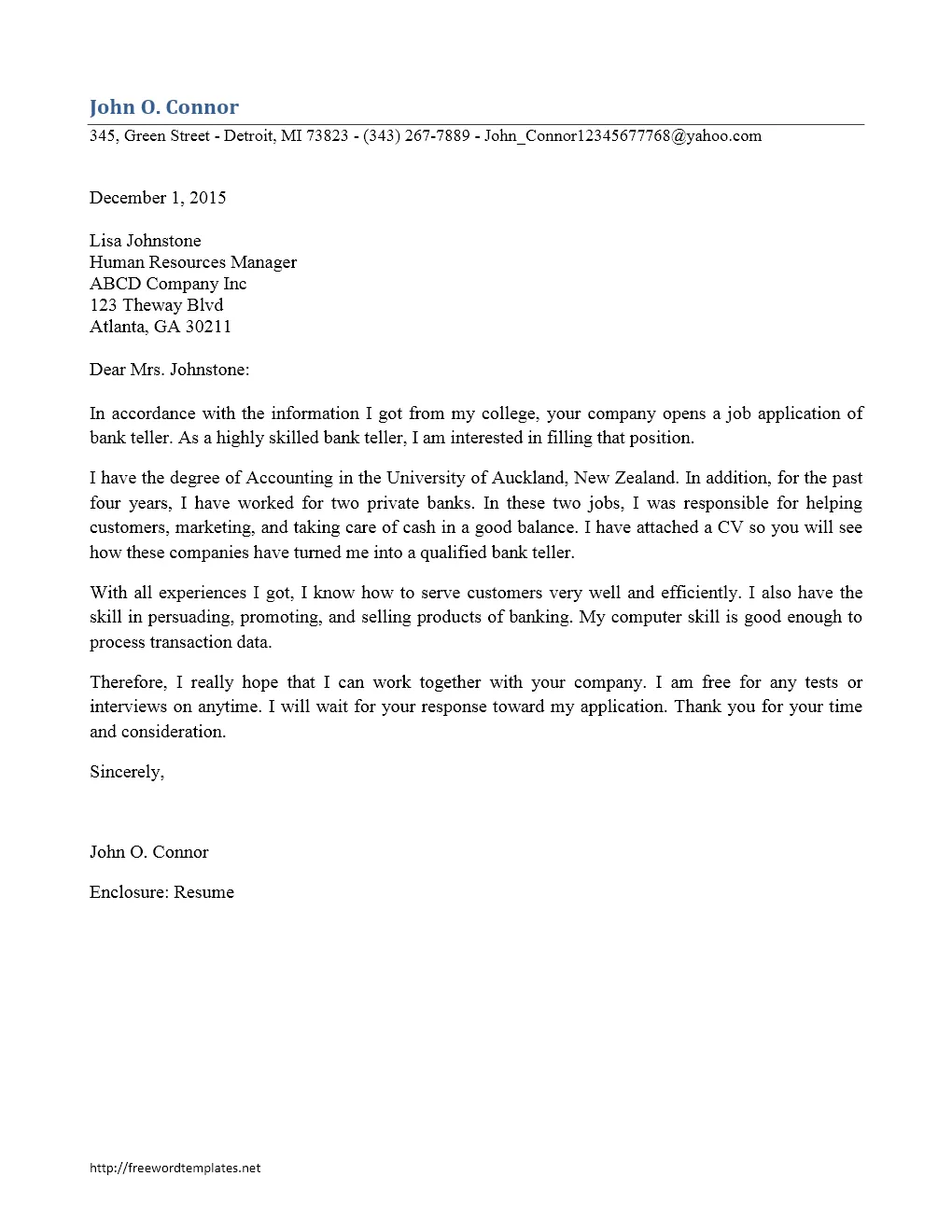

The Header Section

The header of your cover letter should include your contact information and the date. Begin with your full name, followed by your address, phone number, and email address. Make sure your email address is professional. Below your contact information, include the date you’re writing the letter. Then, include the hiring manager’s name (if you know it), their title, and the bank’s address. If you’re sending the letter electronically, you might not need the bank’s address, but it’s still a good practice to include it. Properly formatted header shows that you’re organized and detail-oriented, which are valuable qualities for a bank teller. Ensure the header is neat and easy to read, as it’s the first thing the hiring manager will see. The header sets the tone for the rest of your letter, so make it a strong representation of your professionalism. If applying online, ensure the formatting remains consistent, as some systems may alter the appearance.

The Body Paragraphs

The body of your cover letter is where you make your case for why you’re the ideal candidate. The first paragraph should state the position you’re applying for and where you saw the job posting. Express your enthusiasm for the role and the bank. In the following paragraphs, highlight your relevant skills and experience. Use specific examples to demonstrate your abilities and achievements. Show how your qualifications align with the job requirements. Tailor your content to the specific bank and the job description. Avoid simply restating your resume; instead, elaborate on your key qualifications. In the middle paragraphs, explain why you are interested in working at this particular bank and what you know about it. Research the bank’s values, mission, and culture. Personalize your letter by demonstrating your understanding of the bank’s specific needs and how you can contribute to its success. The body paragraphs are your chance to shine; make them compelling and persuasive.

The Closing

The closing paragraph should reiterate your interest in the bank teller position and express your gratitude for the hiring manager’s time and consideration. Include a call to action, such as stating that you are available for an interview at their earliest convenience. Thank the hiring manager for reviewing your application. You can also provide your contact information again, though it should already be included in the header. Use a professional closing, such as “Sincerely” or “Regards”, followed by your full name. Be sure to proofread your entire letter, including the closing, for any errors. A strong closing paragraph leaves a positive final impression and encourages the hiring manager to take the next step. A well-written closing reaffirms your enthusiasm and leaves the reader with a clear understanding of the value you bring. A professional closing, paired with a well-structured letter, increases the chances of you securing an interview and ultimately, the job.

Cover Letter Examples for Bank Teller

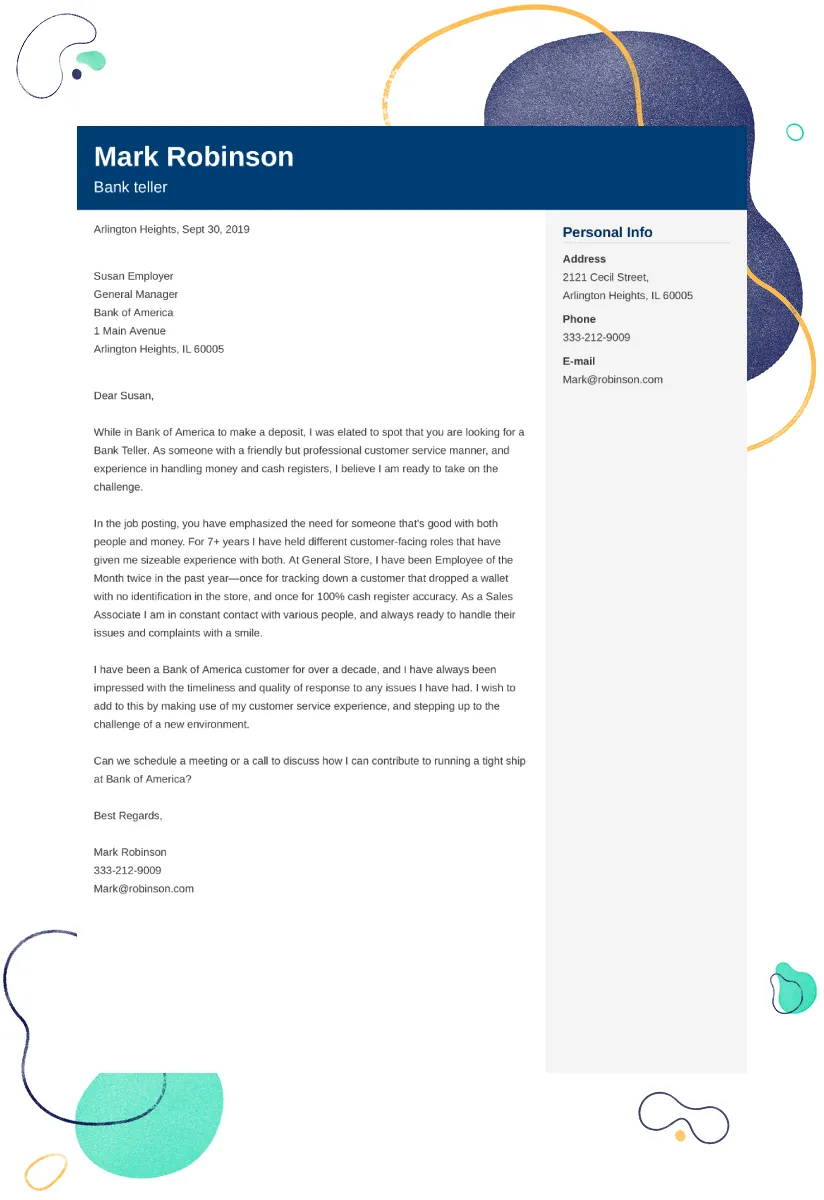

Entry-Level Bank Teller Cover Letter Example

For entry-level positions, your cover letter should emphasize transferable skills and your enthusiasm for the role. Highlight any customer service experience you have, even if it’s from a retail or hospitality setting. Showcase your communication skills and your ability to handle money, even if it’s just personal finance or budgeting. Express your eagerness to learn and your willingness to be trained. Mention your attention to detail and your ability to work in a fast-paced environment. If you have any relevant coursework or certifications, be sure to include them. Tailor your letter to the specific bank and its values. Use a positive and enthusiastic tone. Remember, even without direct banking experience, you can still demonstrate that you possess the skills and qualities necessary to be a successful bank teller. Your cover letter is the opportunity to shine, so make it compelling and persuasive.

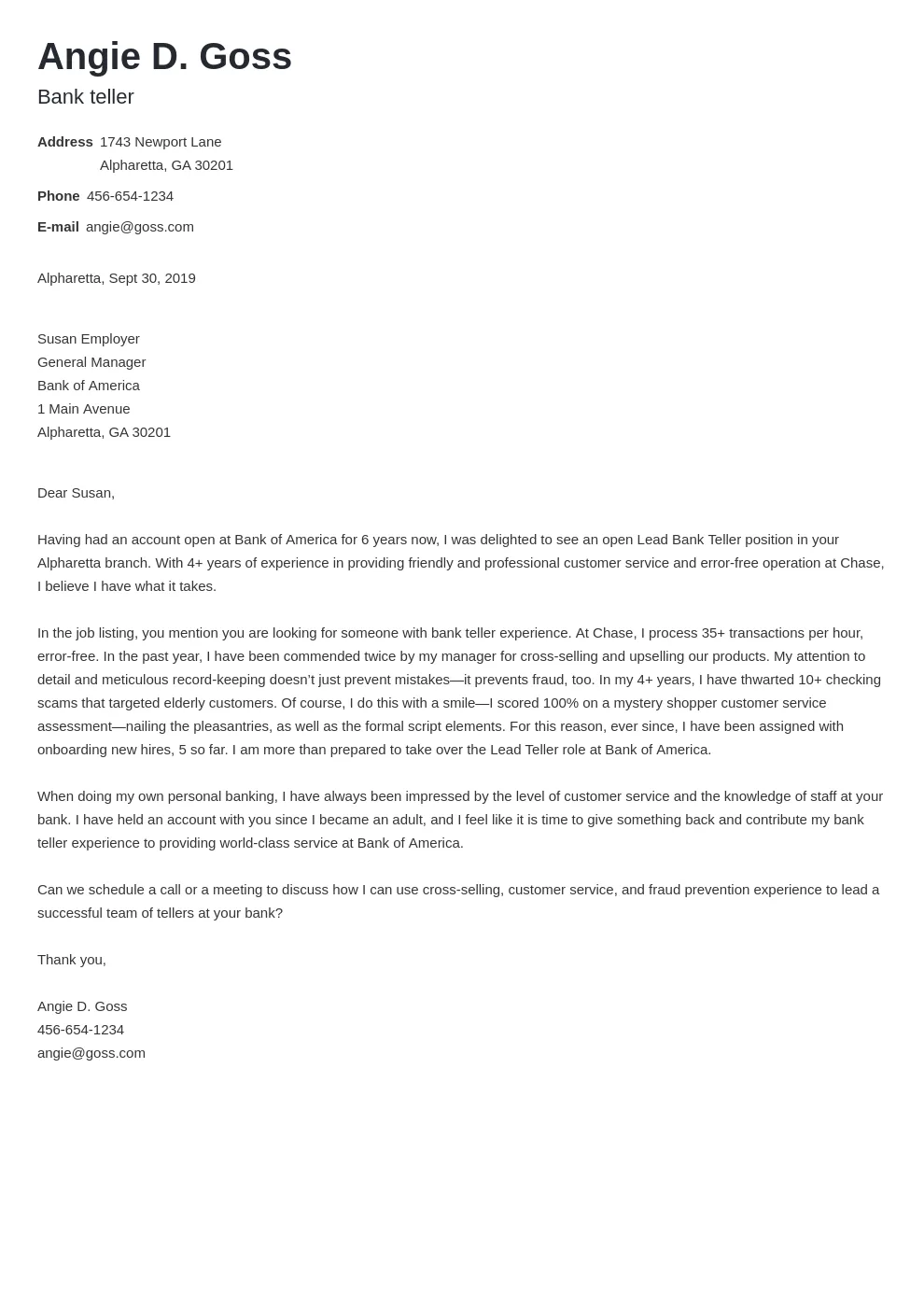

Experienced Bank Teller Cover Letter Example

For experienced bank tellers, your cover letter is the opportunity to showcase your achievements and highlight your expertise. Quantify your accomplishments whenever possible, using numbers to demonstrate your success. Emphasize your experience with customer service, cash handling, and banking software. Highlight any awards or recognition you’ve received. Detail your knowledge of banking regulations and procedures. Show how you have contributed to improving customer satisfaction, reducing errors, or increasing efficiency in your previous roles. Showcase your leadership skills, if applicable. Tailor your letter to the specific bank and the requirements of the job. Your experience is your greatest asset, so make sure your cover letter clearly and concisely demonstrates your value to the prospective employer. Your experience is your key differentiator, therefore, make sure it shines.

Common Mistakes to Avoid

Typos and Grammatical Errors

One of the most critical mistakes to avoid in your cover letter is typos and grammatical errors. These errors can make you appear unprofessional and careless, which can quickly lead to your application being rejected. Proofread your letter carefully, and consider having a friend or family member review it as well. Use a grammar checker to catch any errors you might miss. Read your letter out loud to catch any awkward phrasing or sentences. Ensure your sentences are well-structured and easy to understand. Pay close attention to the details, such as spelling, punctuation, and grammar. A cover letter riddled with errors suggests you don’t pay attention to detail, a crucial quality for a bank teller. A clean and error-free cover letter shows respect for the hiring manager and indicates that you’re serious about the position. Proofreading is an important part of the application process and can be the difference between an interview and a rejection.

Generic Cover Letters

Another major mistake is sending a generic cover letter that isn’t tailored to the specific job or bank. Hiring managers can easily spot these, and they’ll likely toss your application aside. To avoid this, research the bank you’re applying to. Understand its values, mission, and culture. Tailor your cover letter to reflect this understanding. Highlight how your skills and experience align with the bank’s specific needs. Personalize your letter by mentioning the bank’s name and, if possible, the hiring manager’s name. Demonstrate your interest in the position, and show that you’ve put in the effort to learn about the bank. A personalized cover letter shows you’re genuinely interested in the opportunity and have taken the time to understand what the bank is looking for. Customize your cover letter for each job you apply for. This will significantly increase your chances of securing an interview.

Failure to Tailor Your Letter

Failing to tailor your cover letter to the specific job and the bank is one of the biggest mistakes you can make. The hiring manager wants to know why you’re the best fit for their bank, not just any bank. To tailor your letter, carefully read the job description and identify the key skills and qualifications the bank is seeking. Then, highlight your relevant experience and skills, emphasizing how they align with the job requirements. Research the bank and its values. Show that you understand the bank’s mission, culture, and its current challenges. Tailor your letter to address the specific needs of the bank and how you can contribute to its success. Avoid using generic phrases or generic examples. Instead, provide specific examples of how you’ve applied your skills and achieved results in previous roles. Tailoring your cover letter shows that you’re serious about the position and have taken the time to understand the bank’s needs. This personalization makes a strong impression on the hiring manager, increasing your chances of being selected for an interview. Your cover letter needs to resonate with the specific bank you are applying for.